The Debtors List is a list of patients with outstanding balances. This list should be created at regular intervals (normally once per month) and will print one line per patient grouping the debt based on how old it is.

SEE ALSO: ![]() Debtors List Report video (requires portal access)

Debtors List Report video (requires portal access)

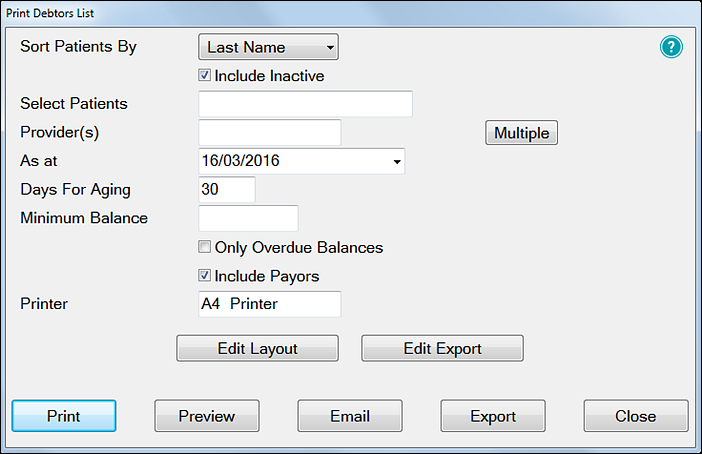

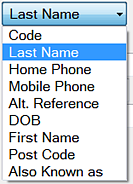

To Print the Debtors List Report

(Note the options to Print, Preview, Email or Export to .CSV)

See also these resources for related Queries information:

![]() Video series for Contact Lists and Queries

Video series for Contact Lists and Queries ![]() (multiple videos)

(multiple videos)

Select a Provider by clicking in the field and using the selector ![]() button.

button.

To print a Debtors List for the entire practice leave the Provider(s) field empty.

Select multiple Providers by means of the Multiple button ![]() .

.

IMPORTANT: See the report example below for an explanation of Current, 30, 60, and 90 days. The reporting rules change depending whether you set a value that is an exact multiple of 30, or that is not an exact multiple of 30.

NOTE: For this report to function effectively, a 'Minimum Balance' figure must be specified.

|

Only Overdue Balances |

If checked this will produce a patient balance summary showing only those patients with overdue accounts; i.e. anyone with a credit balance will not appear on the report. |

|

Include Payors |

Includes amounts outstanding by Payor as well as patients. |

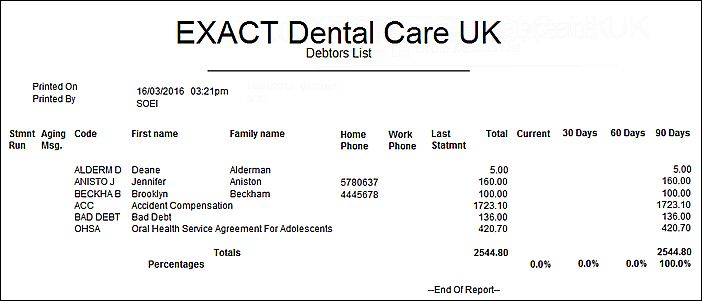

Example:

Last Statement |

This will show the date when a statement was last sent to the patient. |

Stop Credit |

If there is a * in this column it indicates that a ‘stop credit alert’ has been put against the patients record to indicate that they are a bad debt risk. |

Total |

This shows the total amount of money outstanding. |

Current, 30, 60, 90 |

If you set the Days For Aging with a value that is an exact multiple of 30, the following rules apply: The divisions are based on the number of days in the last 1, 2 and 3 month periods. So "30 days" could be 28, 29, 30 or 31 days depending on the month and year. Current is anything more recent than one month prior to today. 30+ days starts from one day after 2 months ago, up-to one month ago. 60+ days starts from one day after 3 months ago, up-to two months ago. 90+ days is anything prior to (and including) 3 months ago. Where "2 months ago" (etc) is calculated by just taking the current date and subtracting 2 from the month. For example, on 24th September 2013: Current is anything greater than (but excluding) 24th August 2013. 30+ days is anything greater than 24th July 2013 up-to and including 24th August 2013. 60+ days is anything greater than 24th June 2013 up-to and including 24th July 2013. 90+ days is anything older than or equal to 24th June 2013. |

|

If you set the Days For Aging with a value that is a not an exact multiple of 30, the following rules apply: The number of days that you've set determines the boundaries of each division. For example, if you set the "Days For Aging" to 40 days and ran the report today 24/9/2013, the divisions would be: Current is anything more recent than 40 days prior to today (i.e. after 15/8/2013) 30+ days starts from one day after 80 days ago (i.e. after 6/7/2013) 60+ days starts from one day after 120 days ago (i.e. after 27/5/2013) 90+ days is anything prior to (and including) 120 days ago. |

SEE ALSO: ![]() Debtors List Report video (requires portal access)

Debtors List Report video (requires portal access)